Rethinking Charitable Giving

August 2025

Letter to Our Clients

Traditionally I write a letter about charitable giving in November, but this is NOT a traditional year.

Charitable giving has long been a powerful way to align money with values, but we are facing major tax changes and Conscious Wealth is here to help you get out ahead of these changes.

Today’s letter will give background on giving and the tax changes you need to know about.

Many of the strategies that worked in the past, like donating appreciated stock, may not deliver the same tax benefits going forward. And there are some new windows of opportunity that, if timed well, could save you thousands in taxes while fueling the causes you care about most.

Before we dive into tactics, let’s step back and name what’s true.

First: Nonprofits matter.

The term ’non-profit’ is a specific tax designation for businesses serving the public good, addressing urgent needs, and building the future we all want to live in. Nonprofit organizations often fill the gaps where government can’t or won’t send money; they are not “less than” businesses. Often their work should never be about profit., e.g., ending human trafficking. That’s why nonprofit businesses go through a process to be recognized as tax-exempt.

Second: Nonprofits are businesses.

As businesses, nonprofits still have all the expenses that other businesses have: payrolls, utilities, insurance, and infrastructure. I’ve heard people argue that the best nonprofits should have no overhead. I call bologna sandwich. Businesses have expenses. I’d rather support an organization with a bold mission, talented team, and professional execution than one that’s scraping by for the sake of optics. Impact demands investment.

Here’s How I Think About Giving: The Three Buckets

Over the years, I’ve found it helpful to organize giving into three buckets:

- Alleviating Suffering

- Creating Hope

- Cultivating Beauty

Bucket 1. Alleviating Suffering

Sometimes people just need food and sleep. It is easy to resonate with the idea of “teaching a man to fish” but sometimes he’s starving. And a starving person, a sleep-deprived person, a person who needs medical care is suffering. That’s where this bucket comes in. In our area, our clients support the Atlanta Community Food Bank. If you’ve ever visited, you know it runs like a business: logistics, partnerships, scale. It’s a masterclass in nonprofit operations. There are many others throughout the world. Organizations in this bucket focus on providing access to healthcare, shelter, and basic human needs. It is only when these needs are met that a person can be ready to move forward.

Bucket 2. Creating Hope

Hope is oxygen, and when it’s scarce, fear sets in. Every year, I support Covenant House in Atlanta. It’s a place for young people to go who have nowhere else and no one else to count on. Sometimes they provide a warm bed. Other times they provide career support, life skills, and the start of something new. I didn’t grow up wealthy, but I also never had to sleep on the street. That contrast stays with me and fuels my support.

Bucket 3. Cultivating Beauty

For years, I thought beauty was a luxury. Now, I think it’s essential. Beauty lifts us, connects us, and reminds us why life matters. Whether it’s a piece of public art, a healing performance, or a thoughtful city park, beauty, art invites us to pause and feel human. I support an Atlanta-based group called Flux that curates experiences to bring art and community together, all free to the public.

So, how does charitable giving affect taxes for 2025/2026? Here’s what you need to know:

What’s Changing in 2026 and Why 2025 Matters

With the passage of the new tax bill there are immediate implications for anyone who gives to charity or plans to. Since the shifts take effect in 2026, the time to act is now.

Here’s a breakdown of the key changes and what they might mean for your giving strategy:

1. New Above-the-Line Deduction for Non-Itemizers

- Deduction: $2,000 (married) or $1,000 (single)

- Must be cash only—no property, stock, or DAFs

- Applies to ~100 million taxpayers who currently can’t deduct charitable gifts

Brandon’s Note: If you take the standard deduction and make cash donations, this is great news. But if you currently itemize, waiting until 2026 could reduce your deduction.

2. 0.5% AGI Disallowance for Itemizers

- You lose a portion of your deduction equal to 0.5% of your AGI

- Example: With a $225,000 AGI, the first $1,125 of giving isn’t deductible

- Strategy: “Bunch” multiple years of giving into one tax year to get the most bang for your generosity

3. Deduction Cap at 35% for Top-Bracket Filers

- Affects filers earning ~$752,000 (joint) or ~$626,000 (single)

- Currently, you get a deduction equal to your tax rate (up to 37%). Starting in 2026, that drops to 35%

- Example: A $100,000 gift could lose $3,575 in tax benefits under the new law

- Strategy: Accelerate big gifts into 2025. A Donor-Advised Fund (DAF) lets you lock in the current deduction and grant the funds over time

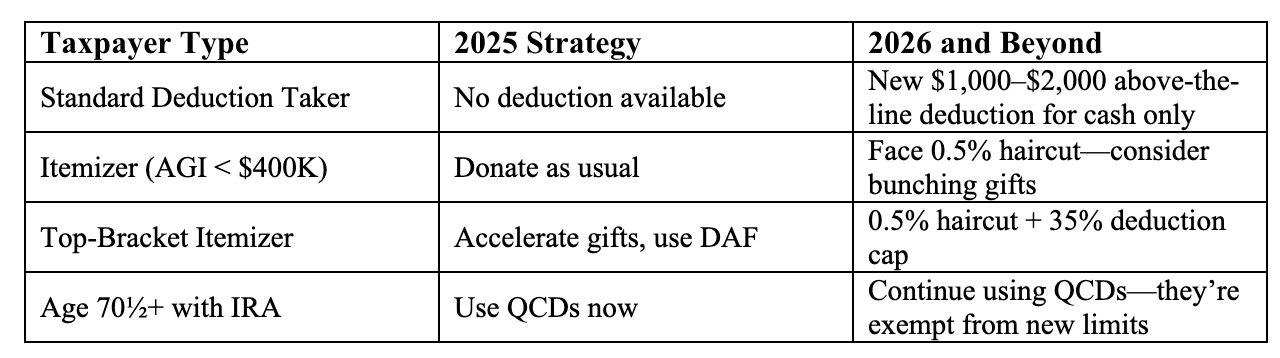

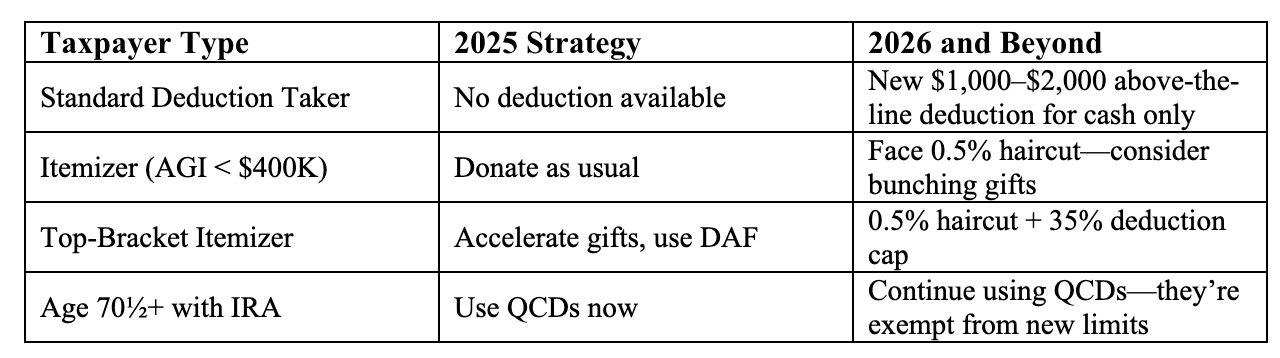

Quick Reference Guide

As always, we recommend speaking with your tax advisor before making any big decisions. If you need help strategizing, we’re here. And if you don’t yet have a tax advisor, or we haven’t synced with yours, just let us know. We’re happy to connect and collaborate.

With gratitude,

Brandon Hatton

President, Chief Investment Officer

Subscribe

August 2025

Letter to Our Clients

Traditionally I write a letter about charitable giving in November, but this is NOT a traditional year.

Charitable giving has long been a powerful way to align money with values, but we are facing major tax changes and Conscious Wealth is here to help you get out ahead of these changes.

Today’s letter will give background on giving and the tax changes you need to know about.

Many of the strategies that worked in the past, like donating appreciated stock, may not deliver the same tax benefits going forward. And there are some new windows of opportunity that, if timed well, could save you thousands in taxes while fueling the causes you care about most.

Before we dive into tactics, let’s step back and name what’s true.

First: Nonprofits matter.

The term ’non-profit’ is a specific tax designation for businesses serving the public good, addressing urgent needs, and building the future we all want to live in. Nonprofit organizations often fill the gaps where government can’t or won’t send money; they are not “less than” businesses. Often their work should never be about profit., e.g., ending human trafficking. That’s why nonprofit businesses go through a process to be recognized as tax-exempt.

Second: Nonprofits are businesses.

As businesses, nonprofits still have all the expenses that other businesses have: payrolls, utilities, insurance, and infrastructure. I’ve heard people argue that the best nonprofits should have no overhead. I call bologna sandwich. Businesses have expenses. I’d rather support an organization with a bold mission, talented team, and professional execution than one that’s scraping by for the sake of optics. Impact demands investment.

Here’s How I Think About Giving: The Three Buckets

Over the years, I’ve found it helpful to organize giving into three buckets:

- Alleviating Suffering

- Creating Hope

- Cultivating Beauty

Bucket 1. Alleviating Suffering

Sometimes people just need food and sleep. It is easy to resonate with the idea of “teaching a man to fish” but sometimes he’s starving. And a starving person, a sleep-deprived person, a person who needs medical care is suffering. That’s where this bucket comes in. In our area, our clients support the Atlanta Community Food Bank. If you’ve ever visited, you know it runs like a business: logistics, partnerships, scale. It’s a masterclass in nonprofit operations. There are many others throughout the world. Organizations in this bucket focus on providing access to healthcare, shelter, and basic human needs. It is only when these needs are met that a person can be ready to move forward.

Bucket 2. Creating Hope

Hope is oxygen, and when it’s scarce, fear sets in. Every year, I support Covenant House in Atlanta. It’s a place for young people to go who have nowhere else and no one else to count on. Sometimes they provide a warm bed. Other times they provide career support, life skills, and the start of something new. I didn’t grow up wealthy, but I also never had to sleep on the street. That contrast stays with me and fuels my support.

Bucket 3. Cultivating Beauty

For years, I thought beauty was a luxury. Now, I think it’s essential. Beauty lifts us, connects us, and reminds us why life matters. Whether it’s a piece of public art, a healing performance, or a thoughtful city park, beauty, art invites us to pause and feel human. I support an Atlanta-based group called Flux that curates experiences to bring art and community together, all free to the public.

So, how does charitable giving affect taxes for 2025/2026? Here’s what you need to know:

What’s Changing in 2026 and Why 2025 Matters

With the passage of the new tax bill there are immediate implications for anyone who gives to charity or plans to. Since the shifts take effect in 2026, the time to act is now.

Here’s a breakdown of the key changes and what they might mean for your giving strategy:

1. New Above-the-Line Deduction for Non-Itemizers

- Deduction: $2,000 (married) or $1,000 (single)

- Must be cash only—no property, stock, or DAFs

- Applies to ~100 million taxpayers who currently can’t deduct charitable gifts

Brandon’s Note: If you take the standard deduction and make cash donations, this is great news. But if you currently itemize, waiting until 2026 could reduce your deduction.

2. 0.5% AGI Disallowance for Itemizers

- You lose a portion of your deduction equal to 0.5% of your AGI

- Example: With a $225,000 AGI, the first $1,125 of giving isn’t deductible

- Strategy: “Bunch” multiple years of giving into one tax year to get the most bang for your generosity

3. Deduction Cap at 35% for Top-Bracket Filers

- Affects filers earning ~$752,000 (joint) or ~$626,000 (single)

- Currently, you get a deduction equal to your tax rate (up to 37%). Starting in 2026, that drops to 35%

- Example: A $100,000 gift could lose $3,575 in tax benefits under the new law

- Strategy: Accelerate big gifts into 2025. A Donor-Advised Fund (DAF) lets you lock in the current deduction and grant the funds over time

Quick Reference Guide

As always, we recommend speaking with your tax advisor before making any big decisions. If you need help strategizing, we’re here. And if you don’t yet have a tax advisor, or we haven’t synced with yours, just let us know. We’re happy to connect and collaborate.

With gratitude,

Brandon Hatton

President, Chief Investment Officer